Market Overview:

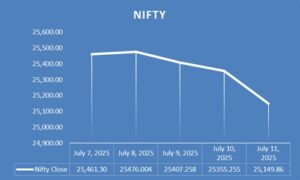

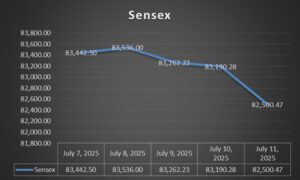

- The week started quietly. On July 7, both Nifty and Sensex ended almost flat. Nifty closed at 25,461, while Sensex inched up by just 0.01% to settle at 83,442. Gains in FMCG and auto stocks helped, but losses in IT and metals limited the upside.

- As the week progressed, market sentiment weakened. By July 10, Nifty had decisively broken below the 25,400 level, closing with a 121-point loss. Sensex also slipped, reflecting cautious investor behavior.

- On July 11, the market saw a sharp fall. Nifty ended at 25,149.85, down 205 points (0.81%), and Sensex dropped 81 points (0.83%) to 82,500.47. This decline was mainly due to:

- Disappointing earnings from IT giant TCS, which dragged the Nifty IT index down by 1.7%.

- Heavy selling in auto and IT sectors.

- Global worries about trade tariffs and a subdued economic outlook.

- Only FMCG and pharma sectors managed small gains, while all other sectors ended in the red

Mutual Funds

- Equity mutual funds mirrored the weak stock market trend, especially those with high exposure to IT and auto stocks.

- Index funds tracking Nifty and Sensex also saw negative returns for the week, as both indices dropped about 1%.

- Debt and liquid funds remained stable, as there were no major changes in interest rates or bond yields.

- Investors preferred defensive sectors, so mutual funds focused on FMCG and pharma performed relatively better.

Currency Markets

During the week of July 7 to July 11, 2025, the Indian Rupee (INR) showed mild volatility against the US Dollar (USD). The rupee started the week slightly weaker and ended with a marginal depreciation. Market sentiment was influenced by global trade tensions and cautious investor behaviour.

- Net change: The rupee depreciated by about 6 paise over the week.

- Percentage change: This represents a 07% decline from Monday to Friday.

- The movement was relatively modest, indicating a mostly stable currency environment despite global uncertainties.

Key Drivers

- Global trade tensions: Continued tariff threats and global economic concerns put pressure on emerging market currencies, including the rupee.

- Foreign investment flows: Cautious investor sentiment led to mild outflows, contributing to the rupee’s slight weakness.

- Regional currency trends: The rupee’s movement was in line with other Asian currencies, which also saw mild depreciation during the week.

International Markets

- Global equity markets were mixed. Asian indices like the Nikkei and Hang Seng declined, while the Shanghai Composite posted small gains. European markets traded mostly higher mid-session, but US futures pointed to a subdued start.

- US markets faced pressure due to:

- Anticipation of new tariffs on automotive imports.

- Weakness in major stocks like Nvidia and Tesla.

- Oil prices edged higher, as supply concerns grew following US tariff threats on Venezuelan oil buyers.

- The euro and Japanese yen remained stable against the US dollar, while the offshore yuan was little changed

Key Takeaways

- Nifty and Sensex fell about 1% for the week, breaking key support levels due to weak IT earnings and global trade worries.

- Mutual funds with exposure to IT and auto underperformed, while FMCG and pharma-focused funds held up better.

- The rupee weakened, reflecting global risk aversion and tariff concerns.

- International markets remained volatile, with trade tensions and earnings season driving sentiment.