Indian Stock Market: Key Developments

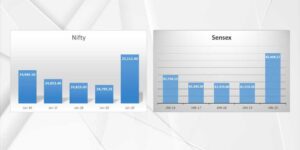

- June 16: Markets rebounded after a previous decline. The Sensex surged 677.55 points (+0.84%) to close at 81,796.15, and the Nifty 50 rose 227.90 points (+0.92%) to 24,946.50. Gains were broad-based, led by IT (notably Infosys and HDFC Bank), and all 11 sectoral indices ended in the green. Mid-cap and small-cap indices also advanced, reflecting positive breadth.

- June 17–19: The market experienced a three-day losing streak, largely due to escalating geopolitical tensions in the Middle East (Iran-Israel conflict), which pushed crude oil prices higher and dampened risk appetite

- June 20: Markets snapped the losing streak with a sharp rebound. The Sensex jumped 1,046 points, and the Nifty 50 breached 25,100, led by financial stocks after the Reserve Bank of India eased provisioning norms for project financing. This policy move helped offset concerns about oil prices and geopolitical risks

Institutional Flows & Market Sentiment

- Foreign Institutional Investors (FIIs): On June 20, FIIs recorded their third-highest single-day net purchase of 2025, buying ₹7,940.70 crore in equities, marking the fourth consecutive day of FII inflows.

- Domestic Institutional Investors (DIIs): DIIs were net sellers on June 20 (₹3,049.88 crore outflow), but remained net buyers for June overall, with inflows nearing ₹59,836 crore

- Market Drivers: The market was influenced by global risk-off sentiment, crude oil volatility, and central bank policy expectations. The RBI’s supportive stance on project financing provided a late-week boost.

Indian Mutual Fund Space

- Industry Growth: As of May 2025, mutual fund assets under management (AUM) reached a record ₹72.2 lakh crore, up 31% of bank deposits. The investor base broadened to 5.4 crore, with sectoral and thematic funds drawing strong inflows.

- SIP Inflows: Systematic Investment Plan (SIP) inflows hit a record ₹26,688 crore in May, reflecting resilient retail participation and a shift toward disciplined, long-term investing

- Recent Trends: While equity inflows moderated in May due to market volatility, domestic funds (especially through SIPs) continued to provide stability and offset FII outflows. The trend highlights the maturing investment behaviour of Indian investors

International Markets Overview

- Geopolitical Tensions: The Iran-Israel conflict drove oil prices to $75/barrel, destabilising global markets and prompting a shift toward defensive sectors like defence and cybersecurity. Global equities were volatile, with defensive stocks and oil-related assets outperforming.

- Central Banks: The week saw key central bank meetings in the US, UK, and Japan. The US Federal Reserve, Bank of Japan, and Bank of England all held rates steady, prioritising stability amid inflation and geopolitical risks. Their forward guidance was closely watched for future market direction.

- Global Economic Data: US retail sales and industrial production were mixed, with services activity robust but manufacturing lagging. In Asia, Japan and China released key inflation and activity data, while the broader APAC region saw mixed equity performance.

- Sectoral Impact: Defence and cybersecurity stocks outperformed globally, while rate-sensitive sectors remained under pressure due to central bank caution and volatility in oil prices.

Key Takeaways

- Indian equities were volatile but resilient, ending the week with a sharp rebound, thanks to supportive policy moves and renewed FII interest.

- Mutual funds continued to experience robust SIP inflows and growing AUM, reflecting a deepening of retail participation and a structural shift in domestic savings behaviour.

- International markets were dominated by geopolitical risks and central bank policy decisions, with defensive sectors and commodities outperforming risk assets.

- The interplay of domestic policy support, strong retail flows, and global volatility defined the market landscape for the week.

In summary: The week of June 16–20, 2025, highlighted the growing maturity of Indian markets, the stabilising role of mutual funds, and the global impact of geopolitical and monetary policy developments.