Indian Stock Market Overview

The Indian stock market experienced a week of alternating gains and losses, ultimately closing on a positive note. The BSE Sensex and Nifty 50 indices both reflected cautious optimism, with investors responding to mixed global cues and domestic developments.

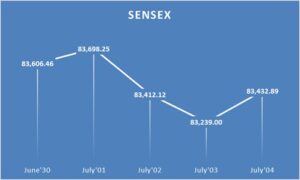

- Sensex started the week with a decline, falling 0.54% on June 30. The index continued to slip midweek but rebounded slightly on July 1 and July 4, closing at 83,432.89, up 0.23% on the final day.

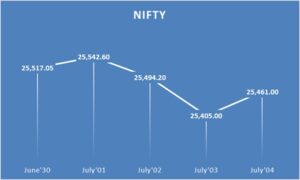

- Nifty 50 mirrored this pattern, ending the week at 25,461, a 0.22% gain on July 4. The index had dropped 0.47% on June 30 and faced further declines midweek before recovering in the last two sessions

Key sectoral movements included:

- Banking and financial stocks dragged indices lower early in the week.

- Public sector banks outperformed, buoyed by renewed optimism from government policy signals.

- The mid-cap and small-cap segments saw selective buying, particularly in capital goods and pharmaceutical stocks.

BSE Sensex and Nifty 50 Daily Closing Values (June 30 – July 4, 2025)

International Stock Markets

Global equity markets maintained their upward momentum, with several indices reaching record highs.

- United States: The S&P 500 rose 4.96% in June, continuing its rally into July. The Dow Jones Industrial Average gained 4.32% for the month, closing at 44,094.77. Optimism over potential trade agreements and robust economic data supported the rally. Technology stocks, especially AI-focused companies, led the gains.

- Asia-Pacific: The MSCI Asia Pacific Index outperformed the MSCI India Index, with Hong Kong’s Hang Seng and South Korea’s Kospi posting strong double-digit gains year-to-date. Indian equities, while positive, lagged behind these regional peers.

- Europe: European markets traded flat, with investors awaiting further policy signals and economic data.

Currency Markets

The Indian rupee faced pressure during the week, influenced by global developments and domestic monetary policy expectations.

- USD/INR traded in a range, opening July near 85.5 and closing at 85.5350 on July 4, reflecting a 0.15% rise from the previous session. The rupee gave back earlier gains as the U.S. dollar strengthened following robust U.S. labor market data and rising Treasury yields.

- The Reserve Bank of India maintained a calm stance, with market participants watching upcoming U.S.-India tariff negotiations for further direction

Currency Table

| Date | USD/INR Close |

| June 30 | ~85.31 |

| July 4 | 85.5350 |

Indian Mutual Fund Sector

India’s mutual fund industry continued to grow, despite market volatility and subdued inflows in some categories.

- Assets Under Management (AUM): The industry’s AUM reached ₹72 trillion in May 2025, marking a 22.5% year-on-year growth. HDFC AMC, with ₹7.5 trillion AUM, remained a leading player

- Equity Mutual Funds: These funds delivered up to 32% returns in the first half of 2025, with sectoral and thematic funds outperforming. Notably, the HDFC Flexi Cap Fund posted a 7.11% return, while Mirae Asset Large Cap Fund returned 6.31% in the same period

- SIP Trends: Systematic Investment Plans (SIPs) continued to attract investors, even as overall inflows moderated. The number of SIP accounts and the total amount collected through SIPs reached record highs

Sectoral Focus

- Defence sector funds gained traction, with HDFC Defence Fund and Motilal Oswal Nifty India Defence Index Fund leading in assets and performance

- Hybrid and large-cap funds remained popular among conservative investors, offering stability with moderate returns

Conclusion

The first week of July 2025 showcased resilience in Indian equities, steady growth in mutual funds, and a rupee that remained sensitive to global cues. International markets continued their bullish run, led by the U.S. and Asia-Pacific indices. Investors in India maintained a long-term focus, leveraging SIPs and diversified mutual fund portfolios to navigate market volatility.